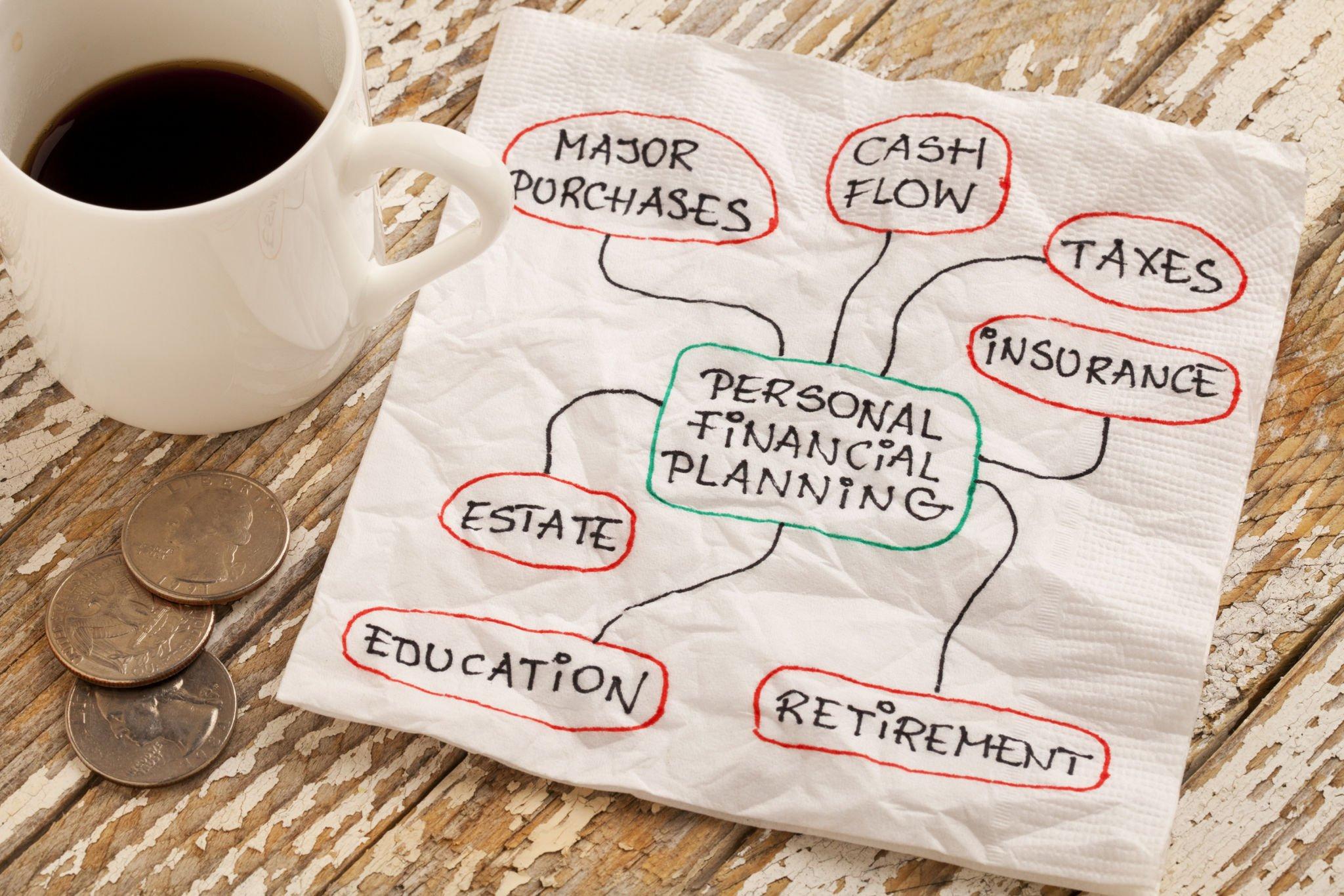

5 Keys to Successfully Managing Your Personal Finances

If there was a magic formula or simple trick that allowed you to manage your finances and stop worrying about money, wouldn’t that be incredible?

Even though it might not be possible, you can take a few simple steps to make financial improvements right now. To correctly manage your funds, try these five methods. One more benefit? Your economic issues may disappear if you follow these five suggestions, and you’ll enjoy the benefits of reduced debt, future savings, and a high credit score.

How to Open Demat Account Online

Best Place To Invest Your Money Right Now.

How To Invest In The Share Market

Can You Invest As A Teenager

1. Describe Your Financial Goals

Take your time defining your specific, long-term financial goals. You can start your retirement early, purchase an investment property, or take a month-long vacation. Each of these goals will influence your financial planning. For example, your ability to reach your early retirement goal will depend on how well you save money now. Managing your finances will also affect other goals, such as relocating, switching jobs, buying a house, and beginning a family.

Prioritize your financial goals after you’ve put them in writing. Using this organizational technique, you can be sure that the people most important to you are receiving the most attention. Although you can list them in whichever order you like, long-term goals like retirement savings must be worked on with other plans.

Here are some pointers to help you define your financial objectives clearly:

Know Your Priorities and Values:

- Consider what is most important to you in life.

- Determine your top priorities, both immediate and long-term.

- These priorities and ideals should be reflected in your financial goals.

Define precise and identified goals:

- Clearly state your financial objectives. Clarify your goals in as much detail as possible.

- To monitor your progress, use tangible standards like amounts and deadlines.

- For example, say you wish to “save money” for a trip.

Think About Various Time Horizons:

- Sort your goals according to when you hope to accomplish them.

- Different strategies could be needed for short-term (one to three years), medium-term (three to five years), and long-term (five or more years) goals.

Assess Your Capacity for Risk:

- Determine your level of comfort by taking financial risks.

- The possible returns on your investments, as well as your investment decisions, will be influenced by your risk tolerance.

Make Inflation Sense:

- Acknowledge that inflation causes money’s purchasing power to diminish over time.

- Make sure your financial goals are still achievable by adjusting them to reflect inflation.

Make a budget:

- Create a reasonable budget that details your earnings, outlays, and savings objectives.

- Within the constraints of your budget, your financial goals must be attainable.

Considering Emergency Funds:

- As part of your financial goals, establish and maintain an emergency fund.

- An emergency reserve shields Your other financial objectives from unforeseen costs.

Diversify Your Investments:

- It is advisable to diversify your investments if accumulating wealth is one of your goals in life.

- Diversification can improve your chances of making a profit while distributing risk.

Evaluate and Modify Frequently:

- Review your financial goals regularly to make sure they still fit your situation.

- As your priorities, income, and spending change, be willing to adjust your goals.

Look for Expert Advice:

- If you would like more detailed advice, see a financial specialist.

- A financial expert can provide advice and solutions specific to your circumstances.

Become Knowledgeable:

- Invest some effort in educating yourself about money matters.

- You can make wise selections with a basic understanding of investing, budgeting, and financial planning.

Take Contingency into Account:

- Recognize that unexpected circumstances can affect your financial goals because life is unpredictable.

- Provide for the possibility of unforeseen events in your plans.

Preserve Adaptability:

- While having specific goals is essential, you should also be adaptable.

- As opportunities and circumstances change, adapt your approach accordingly.

Honour significant achievements:

- Celebrate and acknowledge your small victories along the road.

- Reaching milestones increases motivation and promotes continuous improvement.

- These tips can help you create specific, attainable goals that will lead you to financial success as you arrange your finances.

2. Develop Your Plan

You must achieve your financial objectives with a financial strategy. There should be several phases or goals in the plan. Making a monthly spending plan and budget, followed by debt relief, could be a sample plan.

You might have additional money after completing these three tasks and sticking to your new plan for a few months. The money you save by not having to pay off debt can be utilized to meet your next set of objectives.

Once again, it’s critical to identify your top priorities. While you continue to make steady progress toward your long-term retirement objectives, begin concentrating on the most vital short-term goals you have set for yourself. Would you like to go on a lavish vacation? Invest first? Purchase a house or launch your own company? When determining your next course of action, consider all these points.

Your objectives and an emergency fund can help you take charge of your financial situation and help you avoid making financial decisions out of fear.

Keep the following in mind when making a financial plan:

The secret to success is your budget. You will have the most control over your financial future with this tool. The other goals in your plan cannot be accomplished without your budget.

At any point in your financial plan, you should continue contributing to long-term objectives, such as retirement savings.

Setting up an emergency fund is another essential component of stress management and financial success.

3. Make and Commit to a Budget

One of the most important tools for your financial success is your budget. It enables you to make a spending plan that will help you allocate your funds in a way that will enable you to accomplish your goals.

Your budget can be as broad or specific as you like as long as it will enable you to fulfill your main objectives of saving for the future, paying off debt, increasing your emergency fund, and spending less than you make.

Will make financial decisions for upcoming months and years more accessible with a budget. Without the strategy, you could spend money on items that look significant at the time but don’t improve your future. Many individuals become mired in this maze and become depressed over not achieving the financial benchmarks they set for themselves and their families.

Celebrate even the most minor accomplishments along the journey. Congratulations when you pay off debt, for instance, or give yourself a treat if you stick to your spending plan for three months or increase your emergency fund.

If you’re married, you and your partner must collaborate on the spending plan. Collaborating makes it equitable for you both, and your dedication to reaching the goal is equal. This solidarity will significantly assist you in averting disputes over money. The following advice can help married couples who wish to make a budget together:

For areas of expenditure where more discipline is needed, think about converting to an envelope budgeting system that employs cash.

To input spending in real-time, use budgeting software that integrates with a mobile app.

4. Managing Debt Effectively

Debt is not the same for everyone. Pay off high-interest liabilities first by distinguishing between both positive and negative debts. Think about debt consolidation options and bargain with creditors to get advantageous terms. Strategic debt management is essential to reaching financial independence.

Please promise you won’t take on further debt once you have paid it all off. Keeping credit cards hidden at home could be a wise choice. Establish an emergency fund to help you avoid using your credit card to cover unplanned expenses.

Selling items around the house that you no longer need or want can help you add extra income to your debt repayment plan.

If you want your situation to improve dramatically or quickly, you might need to take a second job to speed up the process.

Look for areas where you may reduce your spending to have more money for paying off debt.

5. Retirement Savings

Financial planning includes retirement planning because most people do not have a safety net waiting for them. One source of retirement income, such as Social Security benefits, might not be sufficient to cover all your costs.

The first steps in developing a retirement plan are selecting how much to save and where to put it. Your age, anticipated retirement age, ideal retirement lifestyle, and risk tolerance can affect how much money you save.9. An online retirement calculator can help you determine how much you should save each month or year.

The retirement savings supplied by your employer is a clear decision regarding where to retain them. A portion of your pay can be deferred into the plan, which will grow tax-deferred until you retire. Additionally, you can increase your savings by opening a regular or Roth IRA with tax benefits.

Protecting Your Property

The purpose of insurance is to provide financial security for you and your loved ones in an emergency. As part of your financial strategy, you may require the following types of insurance:

Health coverage

disability benefits

insurance for life

Homeowners’ or renters’ insurance

vehicle insurance

Insurance for your business, assuming you own one

Speak with an insurance agent, financial planner, or advisor if you’re unclear about what kind of insurance you need or how much coverage is acceptable. An insurance specialist can assess your circumstances and recommend the appropriate coverage to close any gaps in your budget.

Frequently Asked Questions (FAQs) about 5 Keys To Successfully Managing Your Personal Finances

Q1: How do I create a realistic budget?

Start by tracking your monthly income and expenses. Categorize spending into essentials (rent, bills) and non-essentials (entertainment). Allocate a portion for savings and stick to your plan. Regularly review and adjust as needed.

Q2: Is it too late to start investing for retirement if I’m in my 40s?

It’s always possible. While starting early is ideal, even in your 40s, consistent and strategic investing can significantly impact your retirement savings. Consult a financial advisor to tailor a plan to your specific situation.

Q3: What’s the difference between a Roth and a Traditional IRA?

In a Traditional IRA, contributions are tax-deductible, but withdrawals are taxed. In a Roth IRA, contributions are after-tax, but qualified withdrawals are tax-free. Choose based on your current and future tax situation.

Q4: How can I improve my credit score quickly?

There’s no instant fix, but pay bills on time, reduce credit card balances, and check your credit report for errors. Consistency in positive financial behavior will gradually improve your credit score.

Q5: What’s the importance of an emergency fund?

An emergency fund provides a financial safety net for unexpected expenses like medical bills or car repairs. Aim to save three to six months’ living expenses for financial security.

Q6: Should I prioritize paying off debt or saving?

It depends on your situation. High-interest debts should be a priority, as they can accumulate quickly. Simultaneously, allocate a portion of your budget to savings, even if it’s a small amount, to build a financial cushion.

Q7: How often should I review my financial plan?

Regular reviews are crucial, especially during significant life events or changes in income. Reassess annually and adjust your plan to align with evolving goals and circumstances.

Q8: Can I start investing with a small amount of money?

Absolutely. Many investment platforms allow you to start with a modest sum. Consider low-cost index funds or robo-advisors for a diversified and affordable entry into the investment world.

Q9: Should I prioritize saving for my child’s education or my retirement?

Prioritize retirement savings. While education is essential, various ways to fund it include scholarships and loans. Secure your retirement first, as there are limited options for funding retirement.

Q10: How can I protect myself from identity theft?

Safeguard personal information, use strong passwords, monitor accounts regularly, and consider identity theft protection services. If suspicious activity occurs, act promptly to report and resolve it.

Conclusion: about 5 Keys To Successfully Managing Your Personal Finances

I Hope You Have Liked This Post Of Mine On 5 Keys To Successfully Managing Your Personal Finances. How Did You Like The Information? Please Do Give Your Feedback By Commenting. And If You Have Any Problems Or Doubts Regarding This Article. You Can Ask That Question Without Any Hesitation By Commenting. Also, If You Feel That There Should Be Some Improvement In It, Then You Can Also Write Us Comments Below.

If You Liked My Post On 5 Keys To Successfully Managing Your Personal Finances Or You Have Learned Something From It, Then Please Share This Post On Social Networks Like Facebook, Twitter, Linkedin, Etc

1 thought on “5 Keys to Successfully Managing Your Personal Finances”